Research

Satellite Communications

There is tremendous change underway in the satellite communications market. This change is in part driven by substantial investment to build out Low Earth Orbit network, and in part driven by technology advancements in phased arrays. The services for satellite communications are also rapidly changing from unidirectional broadcasting to bursty, bidirectional data onboard aircraft and cruise ships.

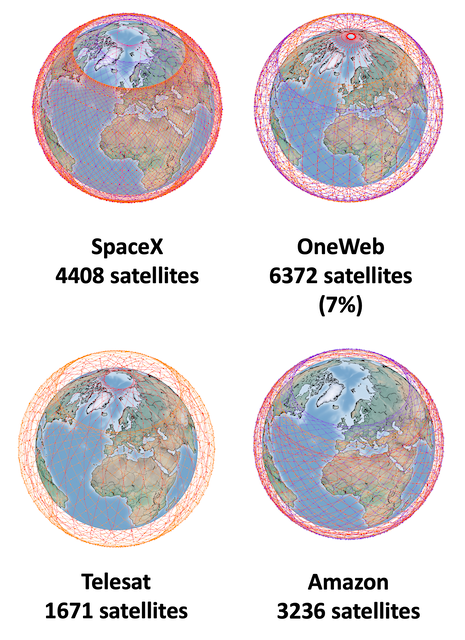

Four new entrants are competing in this market from Low Earth Orbit (SpaceX, Amazon, OneWeb, and Telesat), and in response to the substantial additional supply, several incumbents (Inmarsat, SES, Viasat, Eutelsat) have proposed consolidation and mergers.

Our work has focused on applying computational tools to architect the next generation of space communications by identifying the architectural decisions that characterize the network and building models that provide rapid assessments of their performance and cost.

Our research directions include :

1) Supply assessments of the newly proposed satellite constellations, built on a common baseline model using government license request data submissions. See for example :

A technical comparison of three low earth orbit satellite constellation systems to provide global broadband, 2019

An Updated Comparison of Four Low Earth Orbit Satellite Constellation Systems to Provide Global Broadband, 2021

2) Dynamic resource management for satellite communications. The operations for satcom are remarkably static and manual today, but the coming generation of satellites will offer steerable beams and much smaller footprints. While many previous efforts have simulated sections of the architecture, such as link budgets or orbit location, our work aims to build an end-to-end pipeline of methods for automating beam placement, routing, frequency selection, and power management. See for example :

Frequency Plan Design for Multibeam Satellite Constellations Using Linear Programming, 2022

Static beam placement and frequency plan algorithms for LEO constellations, 2022

3) Revenue management for satellite communications. The market structures used today attempt to lock-in long term contracts at fixed service levels. While these reflect the underlying capital intensive nature of the business, they are unable to monetize freed up capacity. We believe there is substantial opportunity to ‘overbook’ capacity (given that contracted data rate is rarely used), and offer additional services in the process. See for example :

Too Many Beams, So Little Time: Revenue Management in the Next Generation of Flexible Communication Satellites, 2021

[Contract Structures for SatCom: How will Competition from LEO Mega Constellations Change How Communications Services Are Purchased?, 2022

4) Connecting the other half of the world’s population to the Internet. One of the happy accidents of the new LEO constellations is that they are much less localized than a GEO satellite - these constellations will cover the vast majority of the world’s populated areas, inclusive of those areas not well served by Internet access today. We are interested in technical and policy opportunities to connect these populations. See for example :

Connecting the Other Half: Exploring Options for the 50% of the Population Unconnected to the Internet, 2021

Architectural Decisions for Communications Satellite Constellations to Maintain Profitability While Serving Uncovered and Underserved Communities, 2022